Angus Sinclair

A data analytics portfolio

View the Project on GitHub arms3/portfolio

GitHub: arms3

email: async@duck.com

About Me

I enjoy data, cycling, and whisky. The following are some personal projects that loosely follow those themes.

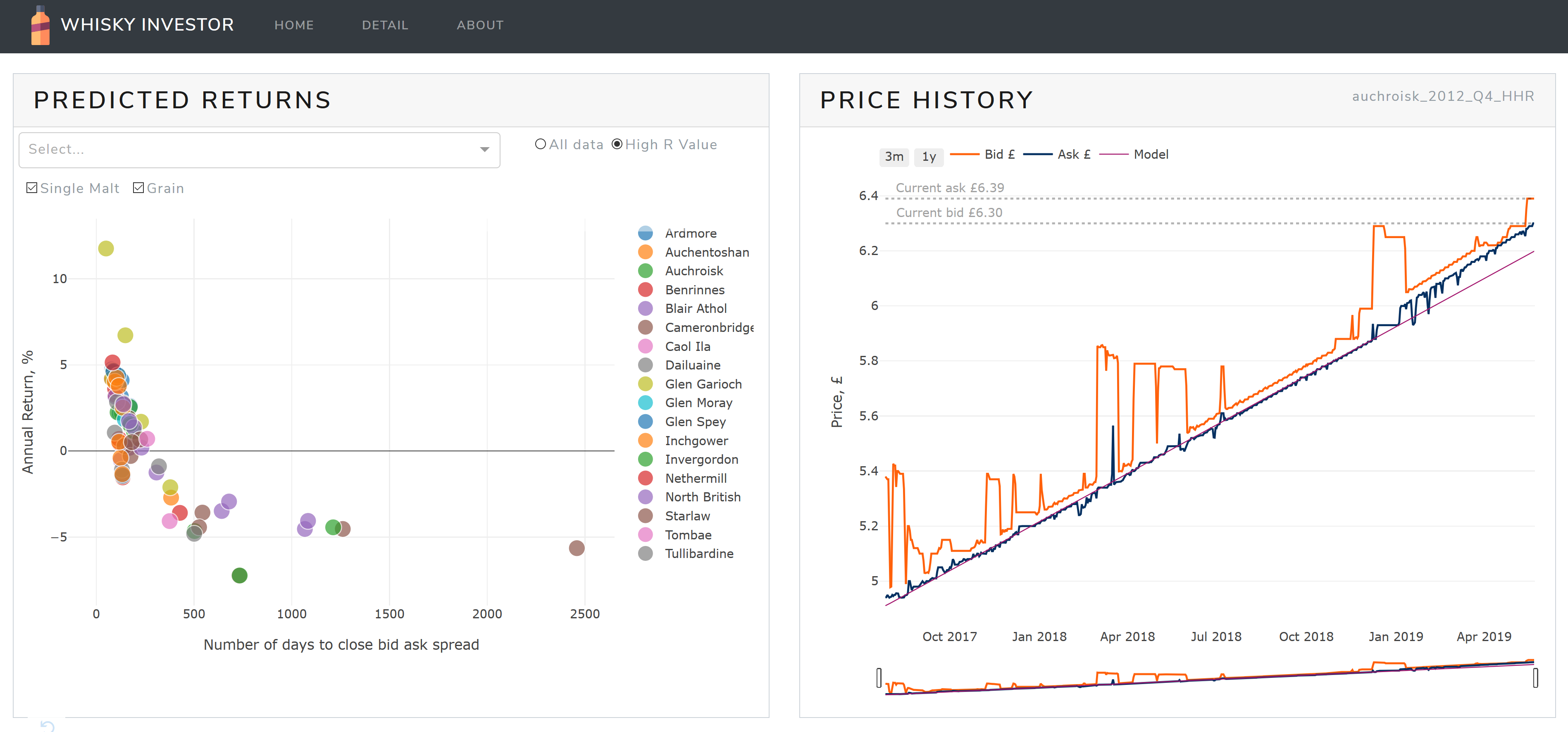

Whisky Investor

| Python | Machine Learning | Dashboard | Web scraping | AWS |

Dashboard to support investing in Scotch Whisky on WhiskyInvestDirect.com. Shows the top current investment opportunities, and a detailed pricing analysis.

Technology and features

- Pricing data scraped using Python (beautifulsoup and regex)

- Daily script deployed on AWS to scrape, process, and model data

- Linear regression and trading cost modelling to predict earnings for each whisky

- Stores daily historic data in an AWS S3 bucket

- Multi page dashboard deployed on Heroku, built using Flask, and Dash by Plot.ly

- Themed using Bootstrap

- Dynamic cross-filtering of charts

Conference Scheduling: A Mixed Integer Programming solution

| Python | Mixed Integer Programming | Scheduling |

Recently Slalom Seattle was planning it’s annual Innovation Symposium, and I was on the planning committee.

The planning team wanted to assign each individual to a schedule. Attendees had been asked to rank their preference for attending each topic. The problem was a large number of schedules would have to manually be created; over 600 attendees, needed to be assigned to 7 different topics across 3 sessions. The original plan was to whiteboard it and manually create schedules and assign people to schedules, an excruciating process that may have to be rerun as new responses or constraints came in. It also seemed difficult to ensure the best solution: how do you even pick the best subset of possible schedules?

There were also some constraints about the capacity of available rooms, more popular sessions could be put in a larger room, and we wanted to avoid having rooms half empty in one session and then bursting at the seams in a later session.

Bike Counter Dashboard

| PowerBI | Dashboard |

Daily bike counter data displayed on a web dashboard deployed using PowerBI, using public OData feed updated monthly.

Technology and features

- Importing web data using PowerBI and OData feed (source)

- Data aggregated by day and hour to show peak activity and trends

- Custom columns and DAX measures to calculate month on month percentage change, reactive to filtered month

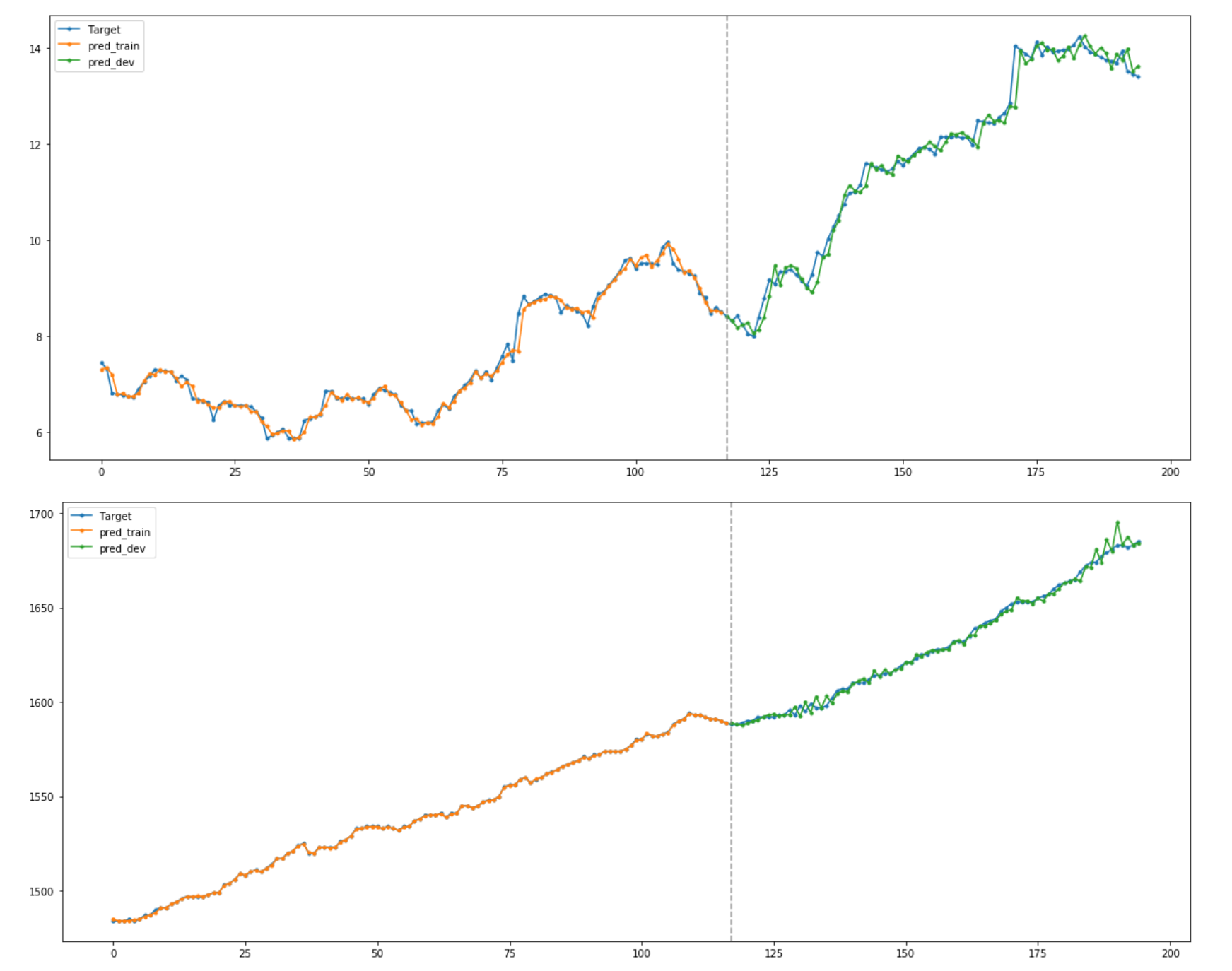

Stock Price Modelling Using LinkedIn Dataset

| Python | Machine Learning | Deep Learning |

Series of Python Jupyter notebooks exploring the relationship between stock prices and LinkedIn employee count data, with the goal of either predicting changes in stock price using employee data or finding an indicator of future hiring patterns or layoffs based on the stock price.

The notebooks attempt to predict future pricing using linear modelling techniques scikit-learn, and non-linear models using PyTorch, however no evidence of improvement over a naïve model (using the previous day value to predict the stock price) was found. The evidence from lagged cross correlation was also inconclusive, and due to the large number of stocks used many of the correlations found may have been spurious.

Notbooks

-

Data load and EDA Loading and viewing datasets, exploring time lagged cross correlation between stock price and number of employees listed on LinkedIn -

Linear modelling Comparison of linear model prediction accuracy with and without LinkedIn dataset -

Neural Network modelling Experiments using a convolutional neural network model based on Google’s WaveNet architecture to predict stock price

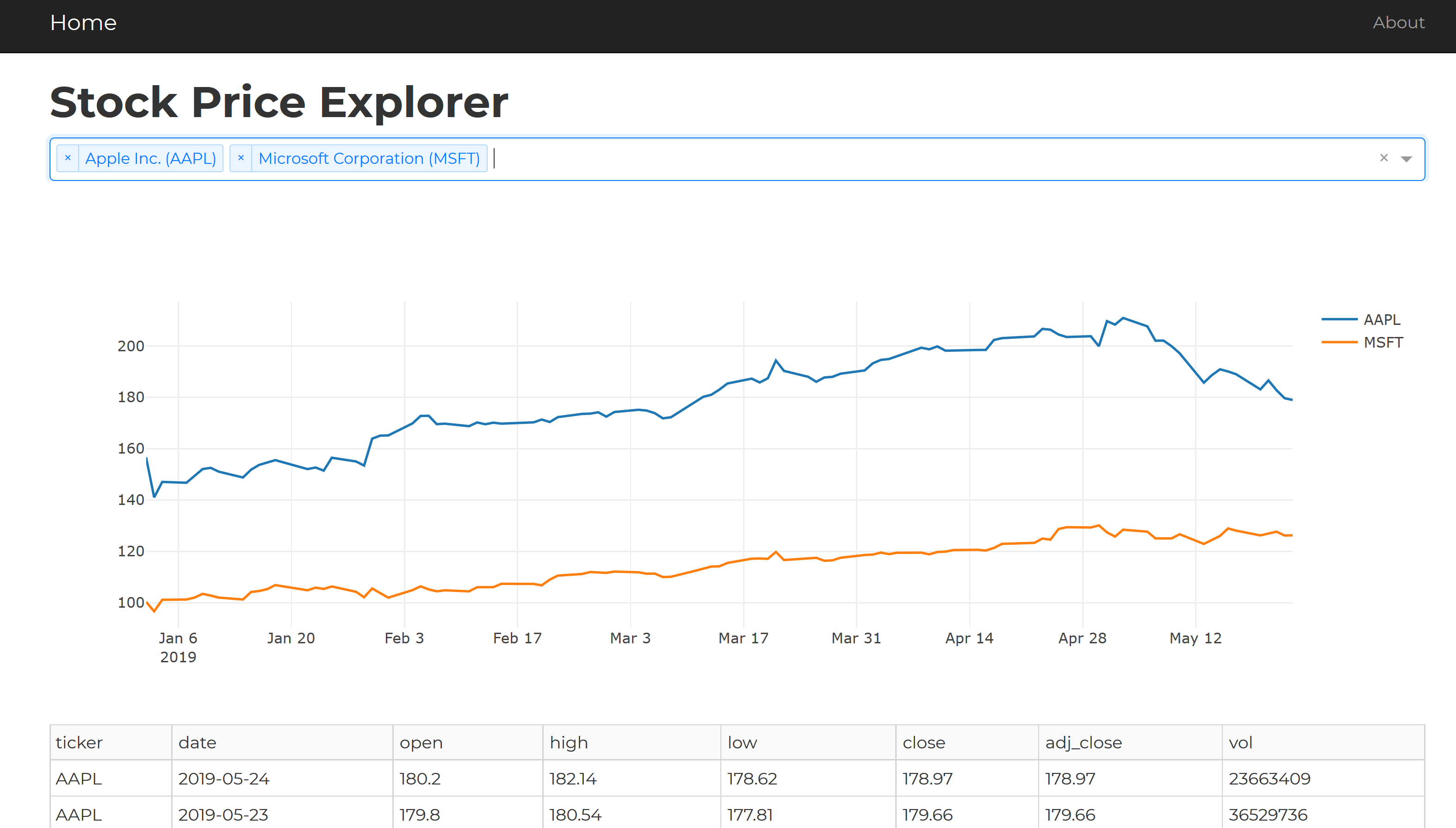

Stock Price Explorer

| Python | Dashboard |

Web App project to display stock ticker information via Dash by Plot.ly.

Technology and features

- Retrieves historic stock price using the AlphaVantage API using Python requests library

- Single page dashboard deployed on Heroku, built using Flask, and Dash by Plot.ly

- Search for stocks via search box with autocomplete

- Caching with expiry to Redis cache on Heroku to reduce the number of API calls (and stay within the 5 calls per minute API restriction)

- Display multiple stocks in chart

- Dynamically updating table of stock prices